SAE J2601: Understanding the International Standard for Gaseous Hydrogen Refueling

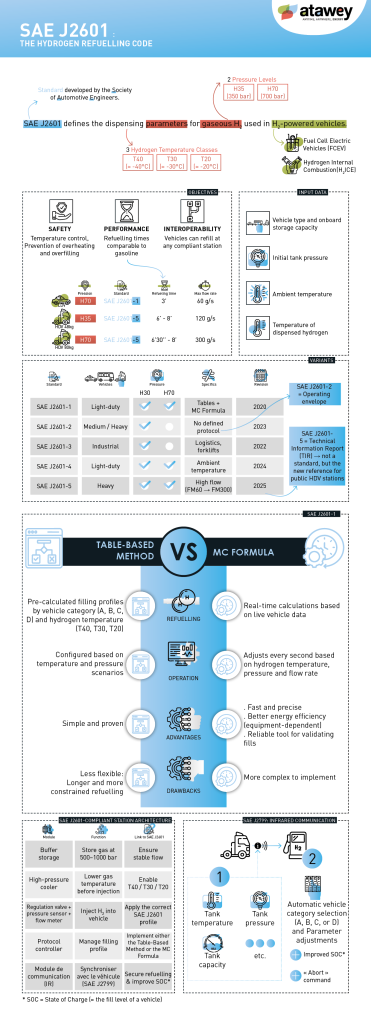

Hydrogen mobility relies on strict technical standards that ensure safety, interoperability, and infrastructure performance. Among them, the SAE J2601 standard plays a central role in the development of hydrogen refueling stations worldwide.

Recognized internationally, it standardizes compressed hydrogen refueling conditions at 350 bar and 700 bar for a wide range of gaseous hydrogen road vehicles: passenger cars, vans, buses, coaches, and trucks.

In this article, we provide a complete technical overview: how the fueling protocol works, critical parameters, refueling profiles, J2601-1 through J2601-5 versions, the thermodynamic method (MC Formula), the SAE J2799 communication interface, and future developments. This guide is designed for professionals who want a deep understanding of the regulatory and technical framework shaping hydrogen mobility.

For an overview, see the infographic at the end of the article: it summarises the SAE J2601 protocol, its variants (J2601-1 to J2601-5) and the key filling parameters.

What Is the SAE J2601 Standard?

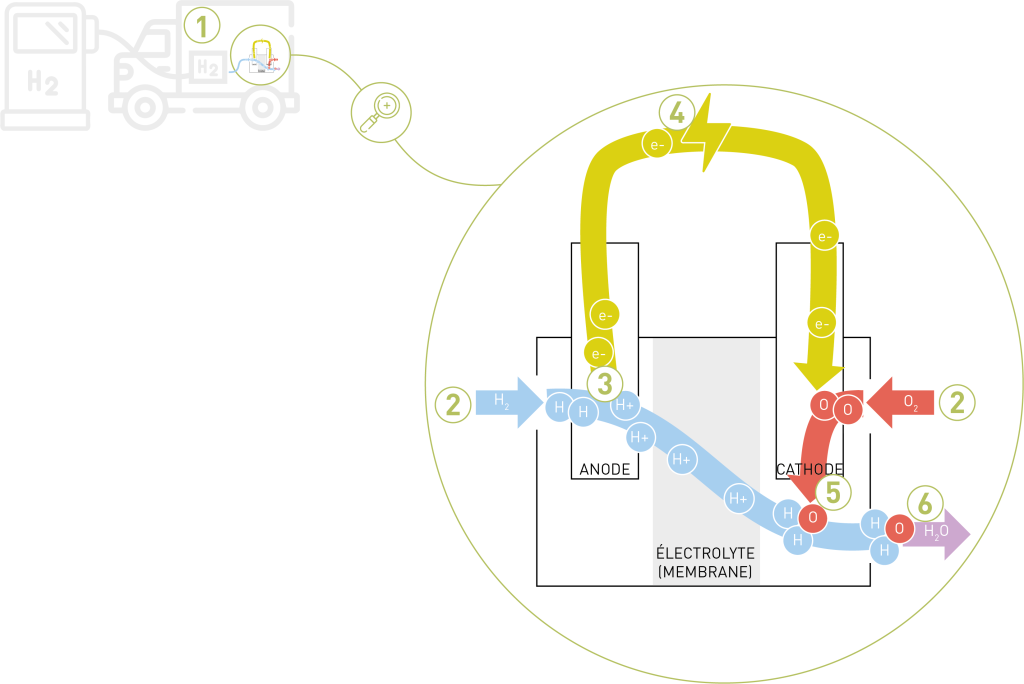

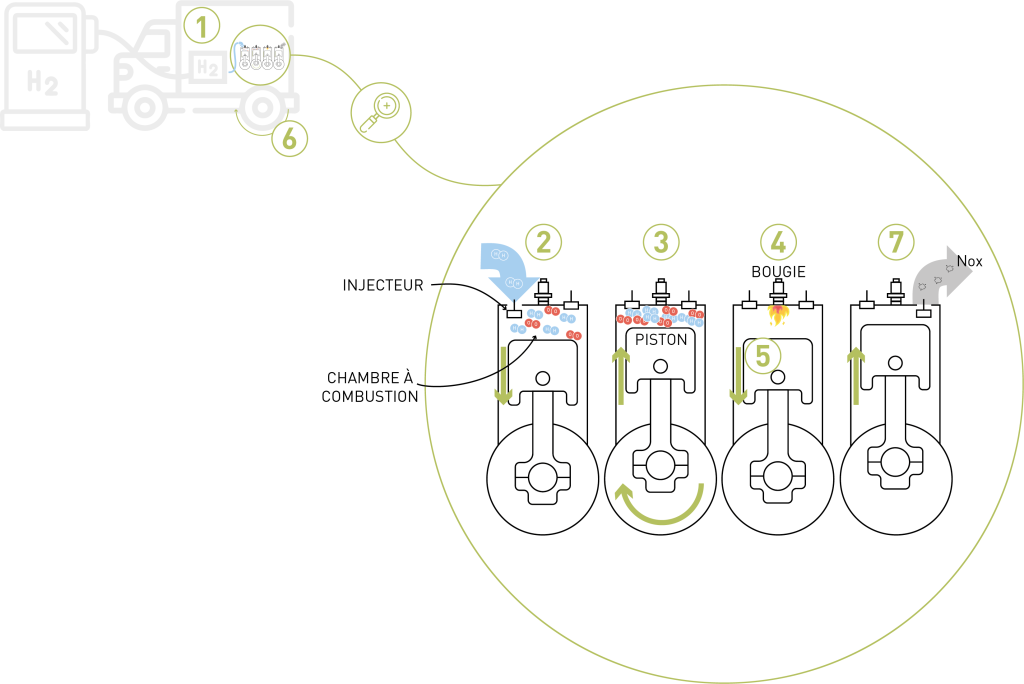

Published by the Society of Automotive Engineers (SAE International), SAE J2601 defines the parameters for dispensing gaseous hydrogen to fuel cell electric vehicles (FCEVs) and hydrogen internal combustion engine vehicles (HICE or H2ICE), taking into account:

-

Two pressure levels: 350 bar and 700 bar

-

Three hydrogen temperature categories at the dispenser: T40 (-40 °C), T30 (-30 °C), and T20 (-20 °C)

Note: These temperature categories will eventually be replaced by performance-based classifications (Fast-Fill, Average-Fill, and Slow-Fill+, under specific conditions).

-

Standardized fueling profiles based on vehicle tank size and initial conditions

-

The presence or absence of an infrared (IR) communication module between the vehicle and the station

SAE J2601: Standard or Protocol?

Strictly speaking, SAE J2601 is a “standard” in the Anglo-Saxon sense—a technical reference document developed by a professional organization (SAE International). In Europe, it would be closer to what is called a regulatory or intergovernmental standard, such as ISO or EN standards.

In practice, SAE standards are widely recognized and used as de facto international standards, including in European hydrogen mobility projects.

As a standard, it:

Is developed through a collaborative technical process involving station manufacturers, dispenser suppliers, vehicle OEMs, tank manufacturers, and station operators

Is officially published and periodically revised

Serves as a reference framework for hydrogen mobility stakeholders

In practical terms, SAE J2601 defines a hydrogen refueling protocol. It:

Specifies how hydrogen fueling at 350 or 700 bar must be conducted

Details standardized fueling profiles (look-up table method)

Authorizes dynamic thermodynamic models (adaptive MC Formula method)

Sets precise safety requirements for temperature, pressure, flow rate, and fueling duration

That is why it is often referred to as the “SAE J2601 fueling protocol.”

In short, SAE J2601 is an international standard that defines the high-pressure gaseous hydrogen refueling protocol.

Did You Know?

Beyond SAE J2601, several other hydrogen refueling protocols are used or under development worldwide.

-

The CEP Wenger protocol, developed by the Clean Energy Partnership (CEP) in Germany, long served as an operational reference for 350 bar heavy-duty vehicles, although it was not issued by an official Standards Development Organization (SDO).

-

The Japanese JPEC protocol is used in public hydrogen stations in Japan and includes specific approaches to thermal management and vehicle-to-station communication.

- Meanwhile, work is underway within ISO (International Organization for Standardization) to establish a unified global hydrogen refueling standard. This future framework aims to harmonize American (SAE), European (CEP), and Asian (JPEC) approaches, particularly within the ISO 19880 and ISO 19885 series.

Main Objectives of the SAE J2601 Standard

Before diving into technical details, it is important to understand the core objectives of SAE J2601:

-

Safety during refueling: prevent overheating, overfilling, overpressure, excessive flow rates, and temperature excursions

-

Interoperability: ensure compatibility between all compliant hydrogen vehicles and stations

-

Performance: enable full refueling with durations comparable to gasoline fueling

For example:

-

A 700 bar light-duty vehicle under SAE J2601-1 targets a 3-minute fill

-

A 350 bar heavy-duty vehicle (2,000 L / approx. 80 kg) under SAE J2601-5 targets 7–8 minutes with a maximum flow rate of 120 g/s

-

A 700 bar heavy-duty vehicle (2,000 L / approx. 48 kg) under SAE J2601-5 targets 7–8 minutes with a maximum flow rate of 300 g/s

Did You Know?

SOC (State of Charge) refers to the hydrogen tank filling level expressed as a percentage of its nominal capacity.

For hydrogen vehicles, nominal capacity is generally defined at 350 bar or 700 bar at 15 °C under standardized conditions.

SOC accounts for temperature and pressure variations that influence the actual stored hydrogen mass.

An SOC of 95% means the tank has reached 95% of its usable capacity, with 100% representing the full performance target.

How SAE J2601 Works

The SAE J2601 fueling standard adjusts hydrogen flow rate and duration based on:

-

Vehicle type and onboard storage volume

-

Initial tank pressure

-

Ambient temperature

-

Dispensed hydrogen temperature

Different Versions of the SAE J2601 Standard

| Standard | Vehicles | Pressure | Scope | Revision |

| SAE J2601-1 | Light-duty vehicles | 350 / 700 bar | Passenger cars, light commercial vehicles + 700 bar heavy-duty (Cat. D) | 2020 |

| SAE J2601-2 | Medium/heavy vehicles | 350 bar | Trucks, buses | 2023 |

| SAE J2601-3 | Industrial vehicles | 350 bar | Forklifts, logistics | 2022 |

| SAE J2601-4 | Light-duty vehicles | 700 bar | Ambient temperature fueling | 2024 |

| SAE TIR J2601-5 | Long-range heavy-duty | 350 et 700 bar High Flow | Buses, coaches, freight trucks | 2025 |

Did You Know?

SAE J2601-2 (350 bar medium and heavy-duty vehicles) is less prescriptive than other versions. It defines an operational envelope (pressure ranges, allowable temperatures, safety tolerances) rather than a detailed fueling protocol.

This gives manufacturers greater implementation flexibility, provided safety and performance requirements are met.

However, for public hydrogen refueling stations, SAE J2601-5 is recommended.

SAE J2601-1: Hydrogen Refueling for Light-Duty Vehicles

SAE J2601-1 defines fueling protocols for light-duty hydrogen vehicles and provides two calculation methods:

-

Look-up table method

-

MC Formula (adaptive thermodynamic model)

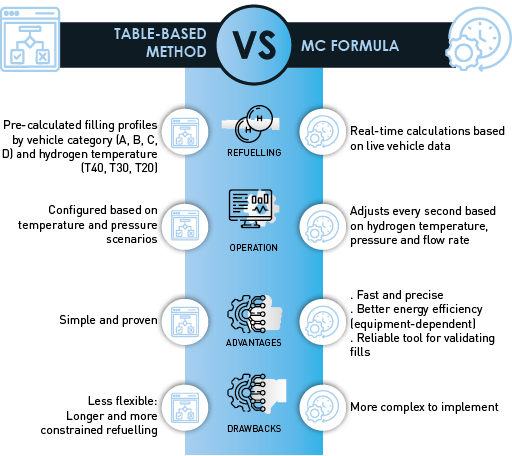

Look-Up Table Method

This historical method relies on pre-calculated fueling profiles (curves A, B, C, etc.) adapted to temperature and pressure scenarios.

It adjusts to ambient temperature.

Advantages:

-

Easier to implement than MC Formula

-

Proven and widely deployed

Limitations:

-

Less flexible regarding hydrogen temperature limits

-

Less precise than MC Formula

-

May result in slower or incomplete fills

MC Formula (Thermodynamic Model)

A more recent approach, the MC Formula uses a real-time thermodynamic model.

It adjusts to:

-

Ambient temperature

-

Mass-weighted average hydrogen temperature

-

Gas properties (pressure, temperature, density)

-

Vehicle tank volume

Advantages:

-

Scenario-based adaptation (including hydrogen temperature variations during fueling)

-

Faster and more accurate fills

-

Improved energy efficiency

*Depending on station components and control strategy

SAE J2601-5: High-Flow Refueling for Heavy-Duty Vehicles

Published in 2025, SAE J2601-5 is a Technical Information Report (TIR), reflecting engineering consensus based on field experience but not yet formalized as a full standard.

It targets public hydrogen refueling stations serving heavy-duty vehicles, including long-haul freight trucks, logistics fleets, coaches, and buses.

Key Technical Features:

-

Pressure levels: 350 and 700 bar

-

Nozzle type: HN1 (H70HD – Heavy Duty)

-

Maximum mass flow classes:

-

FM60: 60 g/s

-

FM90: 90 g/s

-

FM120: 120 g/s

-

FM300: 300 g/s

-

These flow classes enable competitive fueling times (often under 15 minutes) despite large storage volumes ranging from 248.6 to 7,500 liters.

Note: SAE J2601-5 replaces SAE J2601-2 for public heavy-duty stations.

Key Technical Details

Temperature: A Critical Factor

During fast hydrogen refueling, gas compression generates significant heat. Without control, tank temperatures could exceed +100 °C, while vehicle tanks are typically designed for a maximum of 85 °C.

To prevent overheating:

-

Hydrogen is pre-cooled to -20 °C, -30 °C, or -40 °C

-

Tank temperature is monitored in real time when IR communication is available

-

Components are designed to withstand extreme thermal gradients

Pressure Accuracy

Inaccurate initial pressure measurement may cause:

-

Incomplete filling

-

Overpressure risk

High-precision sensors and redundancy systems are therefore used.

The Role of Thermodynamic Models

Advanced thermodynamic models predict hydrogen behavior in the vehicle tank, considering:

-

Gas equations of state

-

Pressure losses across station components

-

Heat transfer between gas, tank wall, and components

-

Thermal inertia

Iterative simulations determine optimal fueling parameters for each scenario.

Conservative Assumptions: “Hot Case” and “Cold Case”

Fueling protocols rely on conservative thermodynamic assumptions to cover extreme real-world scenarios.

-

Hot case: worst thermal scenario (warm tank, high pressure losses). Defines maximum allowable fueling speed.

-

Cold case: cold tank scenario. Defines maximum allowable final pressure.

Simulation results are integrated into look-up tables to protect tank integrity—even without SAE J2799 communication.

These assumptions directly influence fueling time and final SOC, especially when default values are used instead of real-time measurements.

Architecture of an SAE J2601-Compliant Hydrogen Station

| Module | Function | Link to SAE J2601 |

| Buffer storage | Stores hydrogen at 500–1,000 bar | Ensures stable flow |

| High-pressure chiller | Pre-cools hydrogen | Meets T40 / T30 / T20 |

| Dispenser | Inject hydrogen into the vehicle | Applies correct J2601 profile |

| Protocol controller | Manages fueling profile | Look-up tables or MC Formula |

| IR communication module | Syncs with vehicle (J2799) | Improves safety and SOC |

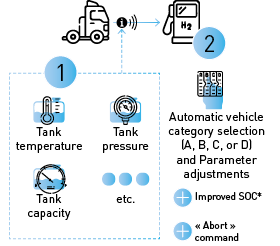

SAE J2799: Infrared Communication Interface

SAE J2799 defines real-time infrared communication between vehicle and station (mandatory in Europe for 700 bar stations).

This one-way communication (vehicle → station) provides vehicle-specific parameters (temperature, pressure, capacity).

Benefits:

-

Enhanced safety

-

Automatic selection of optimal fueling category (A, B, C, D)

-

Faster and more complete fills

In practice, SAE J2799 is essential for safe, fast, and optimized hydrogen refueling.

Future Developments of SAE J2601

The evolution of SAE J2601 is driven by collaboration between OEMs, station manufacturers, standardization bodies, and industry associations (Hydrogen Europe, Clean Energy Partnership , France Hydrogène).

It is based on:

-

Operational feedback from deployed stations

-

Heavy-duty and high-speed charging requirements

-

Field performance data

-

Advances in onboard sensors and communication

In parallel, ISO working groups aim to integrate elements of SAE J2601 into a future unified international hydrogen refueling standard.

Expert Insight: Building Tomorrow’s Standards Together

" The development of standards like SAE J2601 relies on structured collaboration across the hydrogen value chain.

One major challenge ahead is harmonization between SAE and future ISO standards, ensuring global interoperability as hydrogen mobility expands worldwide.

Beyond fueling protocols, ISO, CEN, and AFNOR continue to develop complementary standards supporting a safe, mature, and interoperable hydrogen ecosystem. "

Timo MUTKA

H2 Refueling Expert (Atawey)The SAE J2601 standard structures high-pressure gaseous hydrogen refueling worldwide. By integrating complex technical parameters—temperature, pressure, thermal transfer, dynamic fueling profiles—it ensures safe and fast refueling for most hydrogen vehicles.

It is the foundation of interoperability in the hydrogen mobility sector. Without a harmonized fueling protocol, vehicles could not reliably refuel at any compliant station regardless of manufacturer or country.

Mastering SAE J2601 (J2601-1 to J2601-5), its methods (MC Formula), and its complementary standards (SAE J2799) is essential for any stakeholder deploying or operating high-performance hydrogen refueling stations.

FAQ – SAE J2601 and Hydrogen Refueling

Hydrogen refueling follows a real-time controlled protocol defined by SAE J2601. The station identifies target pressure (350 or 700 bar), pre-cools hydrogen (down to -40 °C), and dynamically adjusts flow rate based on tank pressure, temperature, and IR communication data if available.

An international standard defining 350 and 700 bar gaseous hydrogen refueling protocols for FCEVs and H2ICE vehicles.

J2601 defines the fueling protocol. J2799 defines the IR communication interface.

~3 minutes for 700 bar light-duty vehicles.

7–15 minutes for heavy-duty vehicles under J2601-5.

Look-up tables use predefined profiles.

MC Formula uses real-time thermodynamic modeling for faster and more precise fueling.

To prevent tank temperatures from exceeding 85 °C during rapid compression.

Not legally mandatory everywhere, but it is the global industry reference for public hydrogen stations.

High mass flow classes (up to 300 g/s) for long-range heavy-duty vehicles.

Yes. Updates are ongoing, including convergence with future ISO hydrogen refueling standards.

The infographic below summarizes how the SAE J2601 protocol works and outlines its different versions.

In short, the SAE J2601 standard adjusts the hydrogen flow rate based on the initial tank pressure, ambient temperature, and vehicle profile in order to prevent overheating and overpressure during refueling.